Each algorithm has its own Dashboard with controls to start trading, stop trading, and to exit the marketplace immediately.

For this demonstration live data streams were collected at 30 second intervals and each portfolio was provided $5,000.00 as an initial investment.

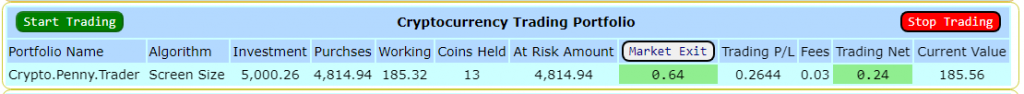

Cryptocurrency Reactive Trading Desk Dashboard

Column Descriptions:

- Portfolio Name

- Algorithm Name

- Investment Amount – Began as $5,000.00 and grew $0.26 trading 13 coins in just minutes

- Purchases – Current investments = $4,814.94

- Working – Amount of working capital to purchase additional coins.

- Coins Held – Number of Coins/Tokens held by the portfolio.

- At Risk Amount – Total Market Exposure

- Market Exit – The amount by which the portfolio is adjusted (up/down) at a Market Exit request.

- Trading P/L – The current trading session’s profit/loss.

- Fees – Broker trading fees – Set at 10%

- Trading Net – The current trading session net profit/loss.

- Current Value – Calculated Portfolio Valuation

In the portfolio above, the Market Exit of $0.64 would be added to the current Trading Net of $0.24 yielding an Adjusted Profit of $0.88 which would be rolled into the Portfolio Investment amount growing the portfolio trading power to $5,001.14 for the next cycle you start.

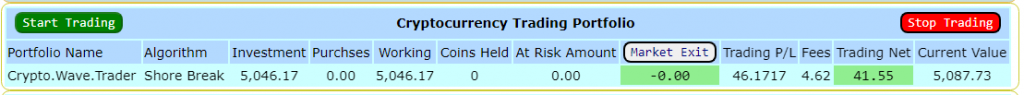

In the portfolio below, the Market Exit is $-13.45 which would be deducted from the current Trading Net of $17.29 to yield an Adjusted Profit of $3.84 at a Market Exit request. Between the two algorithms a profit of $0.88 + $3.84 = $4.72 is collected. A Red Market Exit will charged to the Investment Amount.

The Cryptocurrency Reactive Trading Desk Monitor

Column Descriptions:

- Symbol – Highlighted when actively trading that coin/token.

- Cryptocurrency Name

- Quotes

- Score – Popularity Ranking

- Entry Price – Price at which the coin was bought entering the marketplace.

- Q-Delta – The difference between the Entry Price and the most recent Price Quote.

- Quantity

- Exit Price – Price at which the coin was last sold exiting the marketplace.

- P/L – The Profit or Loss realized from the last trade.

- Previous – The previous quote.

- Quote – The current spot quote.

- Movement – The Positive or Negative movement in the quotations.

The Q-Delta value for an actively trading portfolio coin indicates whether the recent quote is favorable (positive) or unfavorable (negative) to collecting a profit. The coming-and-goings of the coin trading activity in the marketplace.

Market Exit Broker Activity Report

When requesting a Market Exit, the coins are sold at current market prices and the resulting Profit or Loss is indicated.

Stop Trading Request

When a Stop Trading request is made, the algorithm suspends any new purchases and seeks to sell the coins held until a profit can be realized.

Also, in this instance a Market Exit request would charge $-344.47 to the portfolio account.

The Objective is to maintain a Balanced Portfolio with Minimal Risk

This algorithm has grown the initial $5,000.00 by $46.17 and has not bought back into the marketplace which is in a downward trajectory. The portfolio is protected from impulse buying that might result in a trading loss.